Liberalisation FAQ

Phased liberalisation

What is being liberalised in Motor insurance and why

Swipe to view more

|

Before 1 July 2017

|

After 1 July 2017

|

|---|---|

|

Determined by tariff rates based on model, age and engine capacity of vehicles, and discounts in the form of NCD. |

Determined by individual insurance companies and takaful operators based on individual risk profile. |

Key benefits

More choices

Insurance companies will now be able to create new and innovative products with additional value to meet the varying needs of different customers.

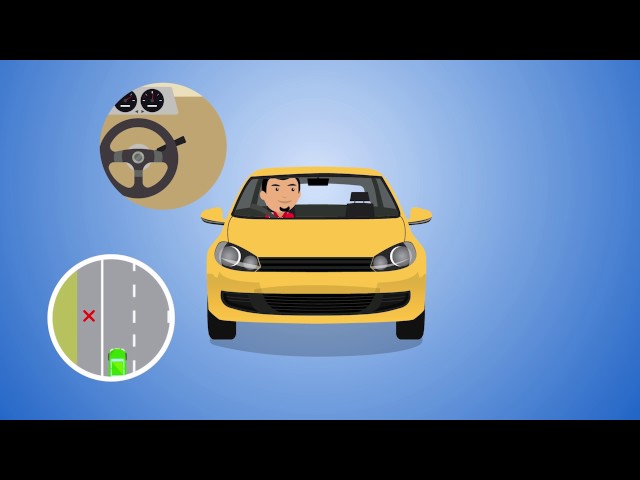

Fairer pricing

Premium / takaful contributions will be priced fairly as it will now be based on individual risk profile. Examples of factors used in other countries for pricing are age of driver, age of vehicle, gender, driver experience etc.

Responsible drivers

Liberalisation will encourage road users to be more responsible as safer drivers could be rewarded with lower premium / takaful contributions.

Make a difference

Talk to us

Chat with us, available Monday to Friday,

8:00am - 8:00pm.

FAQ

A tariff is a set rate under the insurance act to ensure that premium charges and policy wordings are streamlined and controlled. When premiums are tariff, insurance companies are not allowed to vary the prices chargeable on the insurance policy.

Bank Negara Malaysia (BNM), as the supervisory authority for all financial institutions, has the oversight on the application of tariffs. Classes of insurance that are tariff are Motor and Fire.

As Malaysia progresses towards a developed nation status, the insurance market is being opened up to allow a more equitable approach to the charging of premium.

A good risk should be rewarded and a bad risk should be recognised. This means that a good driver should pay lesser premium compared to another driver who is in a class that is more likely to experience many accidents. There should also be incentives for perceived bad drivers to become better risks and be rewarded with reduction in premium.

From 1 July 2017 onwards, premium rates for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

However, premium rates for Motor Third Party product will continue to be subjected to tariff rates.

- An improvement in the quality of service and a wider range of products at competitive prices due to greater competition among insurers;

- The availability of new products with different features that will enable consumers and businesses to obtain the coverage that best meets their insurance needs.

- As safety features will be one of the factors to determine premiums, drivers will be incentivised to inculcate safe driving habits which will benefit them and the general public.

- New distribution channels such as cost efficient online channels would enable insurance protection to be purchased in a manner most convenient to consumers.

There will be wider choices and options of motor and fire products available for purchase and will be more suited to the individual’s needs.

For low risk groups, premiums are expected to be lower. On the other hand, for high risk groups, premiums chargeable are expected to be higher but this can be moderated by risk reduction factors undertaken by the policyholders e.g. safer driving habits to reduce accidents, installation of car telematics or certified anti-theft devices for cars which help reduce theft.

Insurance companies in Malaysia are closely regulated by the BNM and have adequate measures and guidelines in place to ensure proper and prudent underwriting and a sound marketplace. One of the policy intentions of BNM is to moderate the increase in competition and product innovation to ensure the industry and consumers will be able to adapt in a sustainable and gradual manner.

Moreover, the Phased Liberalisation is a continuation of the New Motor Cover Framework. The discussion on Phased Liberalisation between the industry and BNM has taken place since 2013. Various measures have been taken at individual company level with lead times provided to allow all insurers to build internal capabilities and formulate their marketing activities based on their business models. In addition, the liberalisation of the Motor and Fire Tariffs will be implemented in a phased approach, which will allow time for industry to adjust to the new operating environment. In anticipation of adverse unsustainable pricing, the regulator has phased the liberalisation process and insurance companies will need to get approvals if they want to price aggressively. In addition, the Risk Based Capital Framework will ensure companies have adequate funds in place.